tax sheltered annuity 501(c)(3)

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. 501 c 3 is a reference to the section of the US.

Contributions serve to reduce taxable income in the year they are.

. Section 403 b of the. A Tax Sheltered Annuity also called a TSA or 403 b is a retirement plan offered by public schools and certain 501 c 3 tax-exempt nonprofit organizations. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

The terms tax-sheltered annuity and 403b are often utilized conversely. Internal Revenue Code outlining the requirements for an organization to be granted federal tax-exempt status. An organization must be either a tax-exempt organization of one of the types described in IRC Section 501c3 or a public school system.

A 403b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501c3 tax-exempt organizationsEmployees save for. At a high level this. Employees of tax-exempt organizations established under section 501c3.

It is also known as a 403 b retirement plan and. A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities. A 403b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501c3 tax-exempt organizationsEmployees save for.

An organization in either of these two categories. Tax sheltered annuities for employees of Section 501C 3 organizations and public schoolsFEDERAL INCOME TAX ON INSURANCE AND EMPLOYEE. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public schools and.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. A Tax Sheltered Annuity also called a TSA or 403b is a retirement plan offered by public schools and certain 501 c3 tax-exempt nonprofit organizations. As an employee of a school religious organization hospital or Section 501c3 nonprofit organization you have a unique opportunity to regularly set aside.

Free Online Library. According to the IRS a 403b plan or tax-sheltered annuity TSA differs from a 401k in that it can only be offered by public schools and certain tax-exempt organizations. Nonprofit organizations that qualify under 501c3 of the IRS code might offer TSA plans to their employees.

Tax Sheltered Annuity Contributions. These organizations are usually referred to as section 501c3 organizations or simply 501c3 organizations. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501c3 and 403b of the Internal Revenue Code.

Massmutual What S In A Name A Retirement Plan Comparison

What Is A 403 B For Nonprofits Instrumentl

403b Tsa Annuity For Public Employees National Educational Services

Source Irs Gov Design C 2010 Zywave Inc All Rights Reserved Ppt Download

Registration Statement Including A Prospectus N 4

The Tax Sheltered Annuity Tsa 403b Calculator

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

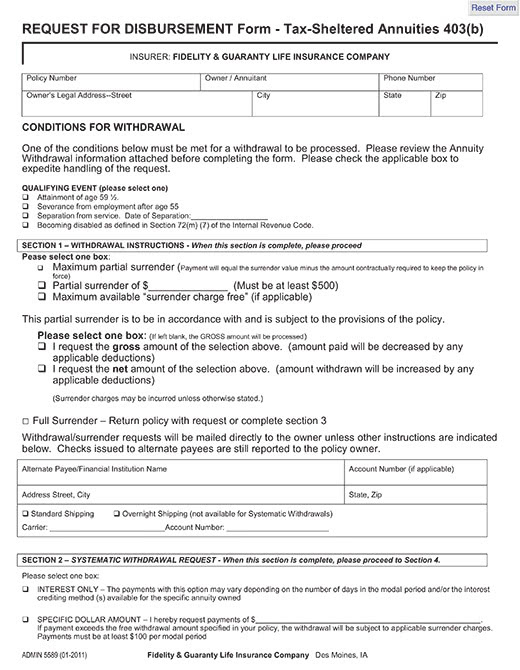

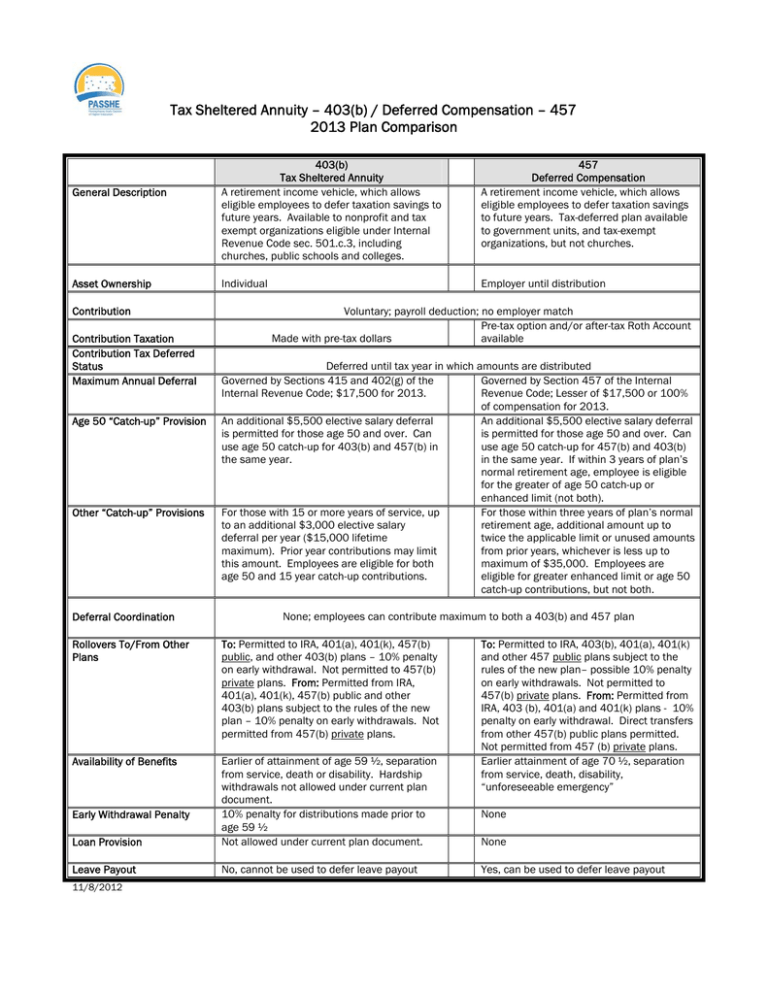

Tax Sheltered Annuity 403 B Deferred Compensation 457

403 B Plans Managing Them Can Be Like Herding Cats Employee Benefits Law Group

457 Plan Vs 403 B Plan What S The Difference

Fiduciary Litigation Best Practices For 403 B Plan Fiduciaries Butterfield Schechter Llp

Nonprofit 401 K The 403 B Plan Vs 401 K Plan Shortlister

403 B Retirement Plans What Ministries Need To Know Ministryworks

What Is A 403b Tax Shelter Annuity And How Does It Work

Is A Tax Sheltered Annuity Qualified

:max_bytes(150000):strip_icc()/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)